Table of Contents

With Bitcoin's price reaching around $47,000 at the end of March 2022, then gradually dropping to about $16,000 by mid-November 2022, and now back to $67,000, even casual observers notice its significant volatility. The market swings between panic and excitement, making it unpredictable.

A friend asked me, what mindset should one have when investing in cryptocurrencies? Is it a Ponzi scheme? How can I tell if the market is good or bad? Are we in a bear market? Is there a simple way to quickly understand the current market situation?

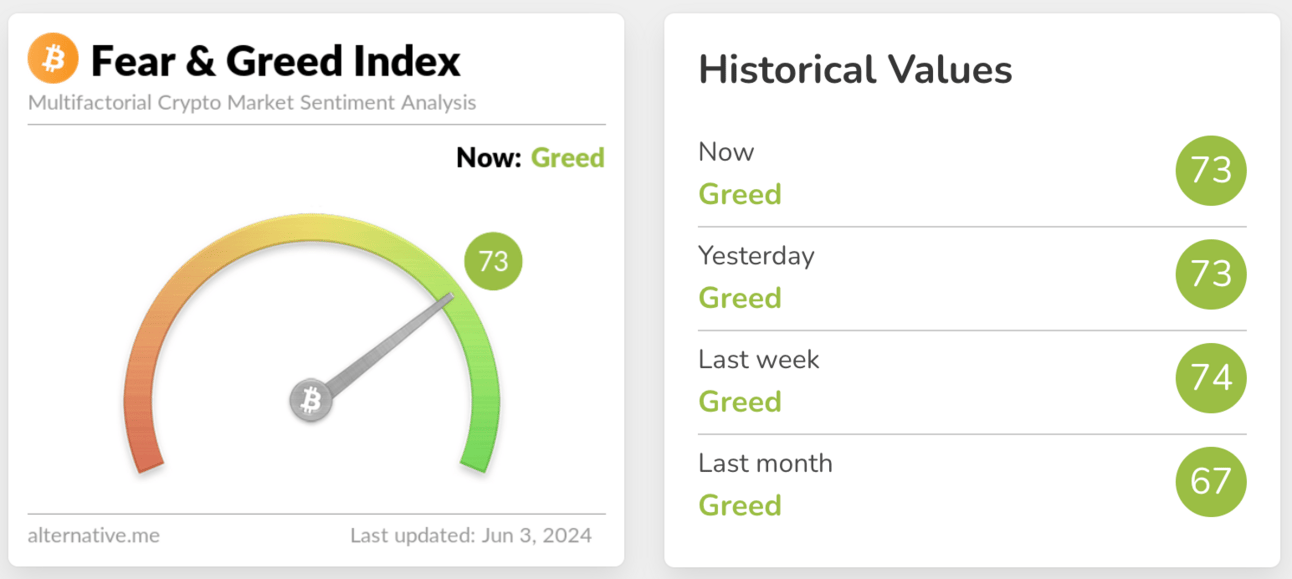

Yes, there is! You can look at the Crypto Fear and Greed Index by Alternative.me. This index is based on CNNMoney's index for the U.S. stock market but tailored for cryptocurrencies.

Crypto Fear and Greed Index

Crypto Fear and Greed Index

This index compresses Bitcoin's market sentiment into a numerical scale from 0 to 100; 0 represents extreme fear, and 100 represents extreme greed. The official website provides a simple definition of how to use this data:

When the market is extremely fearful, it indicates that investors are overly worried, which could be a buying opportunity. Conversely, when the market is extremely greedy, it usually means a market correction is due.

This aligns with Warren Buffett's famous saying:

Be fearful when others are greedy, and greedy when others are fearful.

Components of the Fear and Greed Index

The index consists of the following components:

Volatility (25%): Based on the average volatility and maximum drawdowns of Bitcoin over the past 90 days, compared to the last 30 days. An abnormal increase indicates market fear.

Market Momentum/Volume (25%): Compares the average volume of the last 30 days to the past 90 days. An abnormal increase usually signifies market greed.

Social Media (15%): Analyzes text from Twitter posts discussing Bitcoin. A high volume of discussions is often seen as a sign of market greed.

Surveys (15%): Previously conducted via strawpoll.com, but this factor is now discontinued.

Dominance (10%): Measures Bitcoin's market share. A low dominance indicates excessive market greed, with funds flowing into altcoins. A high dominance suggests market fear, with funds staying in Bitcoin.

Trends (10%): Observes Google Trends for keywords. For example, a rise in searches for "Bitcoin price manipulation" indicates market fear.

Practical Application

What are your thoughts after reading about this index? Share your observations on the relationship between this index and Bitcoin prices, and your trading experiences.

Generally, the index correlates highly with Bitcoin's price movements. When it rises, Bitcoin tends to rise; when it falls, Bitcoin tends to fall, leaving little room for trading opportunities. However, observe the following chart:

The top shows Bitcoin's price chart, and the bottom shows the index. On 2020/07/29 (vertical dashed line), market sentiment and Bitcoin's price diverged, signaling a good buying opportunity. The sentiment was high, but the price hadn't reflected it yet. Similarly, in November of the same year, sentiment peaked, but the price continued to rise afterward.

Similarly, in the chart below, price and sentiment are out of sync:

When the price started to decline from 2021/12/06 (vertical dashed line), market sentiment had already dropped to a low of 16 (0 being the lowest), but the price didn't bottom out until the end of 2022. This is another instance of non-synchronization.

Conclusion

If you want to use this index for trading, you can:

Follow the official definition: sell or short when the market is greedy, buy or go long when the market is fearful.

Look for discrepancies between market sentiment and price, indicating trading opportunities.

However, this is just one of many indices and tools. I will introduce more interesting tools in the future. Since its correlation with price isn't 100%, it can be a reference for buying and selling but shouldn't be relied on entirely.

Always conduct your own research. Feel free to comment and discuss below or share how you use this investment index.

=

This article is solely for educational purposes and does not constitute investment advice. Investors should be aware that all investments carry risks.