Table of Contents

The new project on the Bitcoin chain, Runes Protocol, is currently very popular.

It has caused congestion on the Bitcoin chain, with transaction fees soaring to nearly NT$1,000.

What exactly is this seemingly random string (e.g., Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z)?

Is it truly valuable and worth investing in?

Before diving in, let's first understand its essence and background.

Runes: A New Fungible Token (FT)

Created by Casey Rodarmor, the Runes Protocol aims to provide a more efficient fungible token standard on the Bitcoin chain.

I know, a lot of jargon can be confusing.

In simple terms, a protocol is a mechanism for issuing tokens.

The old protocol (BRC20) on the Bitcoin chain generated data clutter during transactions, causing slowdowns.

The new Runes Protocol aims to solve this problem.

What is a fungible token?

A fungible token means that all issued tokens are identical and interchangeable.

Yes, popular tokens like BTC and ETH are also fungible tokens.

For example, the BTC I buy and the BTC you buy look the same, so we can exchange them as a means of value transfer.

So, don't mistake the Runes Protocol for issuing NFTs (non-fungible tokens, where each token is unique); Casey's previous Ordinals Protocol was for issuing NFTs.

What's Different from the BRC20 Protocol?

There are many terms (BRC20, Runes Protocol), so let's do a quick comparison.

Simply put, BTC is the native currency of the Bitcoin network, like TWD in Taiwan or USD in the US.

The old BRC20 protocol aimed to build an ecosystem on the Bitcoin network, creating dozens of tokens, similar to companies issuing their own tokens within a country.

For example, MOMO coin by Taiwan's MOMO e-commerce, P coin by PChome, etc.

The new Runes Protocol aims to replace BRC20 due to its technical debts and structural issues.

Runes Protocol also allows token issuance.

It solves the BRC20 protocol's problem by reducing redundant data during transactions.

Less clutter on the Bitcoin chain improves server performance and transaction speed.

Higher efficiency and less congestion also lower transaction fees.

But,

Why are Bitcoin transaction fees still high recently?

The redundant data issue is solved, but the chain is still congested due to high demand since its launch (April 2024), temporarily driving up fees.

However, this is temporary. Solving Bitcoin's structural issues still holds value.

After clarifying that the Runes Protocol issues FTs, not NFTs,

Let's investigate the motivation and background of its creator.

After all,

"Investing is investing in people."

Zhang Lei of Hillhouse Capital once said that the most important thing in investment is the ability and quality of the founder and team.

Are you curious about Casey Rodarmor, the creator of the Runes Protocol?

Why did he create the Runes Protocol?

The Ideal of a Technical Innovator

In the blockchain world, Bitcoin's blockchain was initially the only one.

But later, there were Ethereum, Binance Smart Chain, etc., over a hundred chains.

Each chain is operated and created by an organization.

So, there are many developers and applications (NFT, DeFi, GameFi, etc.). Ethereum has the most applications and is the second-largest public chain.

With applications, usage increases, making the chain more complex, and leading to higher transaction fees.

Therefore, Ethereum's fees are high.

But high fees mean miners (who package your transactions into blocks) are profitable, improving verification and security quality, and creating a positive cycle for the chain.

However, Bitcoin's blockchain is heading towards a negative cycle.

No applications, miner rewards halving every four years, making it less attractive over time.

As a Bitcoin enthusiast, Casey Rodarmor couldn't let this happen! (He might also hold a lot of Bitcoin)

So, he created the Ordinals Protocol for artists to issue NFTs on the chain; then the Runes Protocol for projects to issue tokens (FT).

Despite admitting in a Bankless podcast that 99% of these NFTs and FTs are worthless,

He still wants to save Bitcoin, attracting attention from ETH and BNB back to Bitcoin's chain applications.

After all, Bitcoin is the largest and most decentralized blockchain.

I was moved to listen to this podcast at midnight.

Famous developers often have strong motivations to contribute to the community.

This has etched Casey Rodarmor's name deeply in Bitcoin's history.

Imprinting Artistic Passion Indelibly

Curiosity led me to research Casey Rodarmor's background.

Rodarmor is not a traditional developer.

In his youth, he wasn't a model student, experiencing multiple dropouts and failures, but his love for computers led him to UC Berkeley.

Later, he worked at Google as a site reliability engineer, managing data traffic.

He then joined Chaincode Labs, working on Bitcoin core protocol implementation, sparking his love for Bitcoin.

Interestingly,

Rodarmor has a deep interest in art, evident in his diverse activities. He once tried making an instrument using capacitive sensors and microcomputers, similar to a theremin.

But his favorite works are "large abstract metal sculptures."

This inspired him to “etch” something on BTC.

In the Bankless interview, he mentioned that people don't know what they buy as NFTs, only his Ordinals Protocol truly writes NFT data on the Bitcoin blockchain.

Here's a brief explanation.

NFT projects on Ethereum or other chains actually write the "link" to the artwork's image or video on the blockchain, not the original file.

This means the link is immutable, but if the linked server (single server) shuts down, your NFT won't display the image (because the link is broken).

Funny, right?

So, when the Ordinals Protocol launched, the Bitcoin chain was congested, and fees soared because people were buying "real" on-chain NFTs.

Understanding Casey Rodarmor's motivation behind creating these two protocols,

You might wonder, is Runes valuable? Is it worth investing in?

That's a good question.

How do we define the value of Runes?

Strange, Novel Naming Mechanism

Look at these ten names:

- UNCOMMON•GOODS

- Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z

- DECENTRALIZED

- DOG•GO•TO•THE•MOON

- THE•RUNIX•TOKEN

- DOG•DOG•DOG•DOG•DOG

- SATOSHI•NAKAMOTO

- MEME•ECONOMICS

- RSIC•GENESIS•RUNE

- LOBO•THE•WOLF•PUP

Do they look like gibberish? Runes?

They represent different historical events in the crypto world. I won't elaborate here; feel free to comment if interested.

These long names represent a unique naming mechanism.

Currently, Runes names must be 13-28 characters long.

This prevents name squatting.

A good name can be a business.

You might not know who created the x.com domain (now Twitter).

But Elon Musk bought it for his Twitter, estimated at $5 million! Not to mention Voice.com, insurance.com, which were million-dollar acquisitions.

This shows companies are willing to spend big on simple, attractive domains.

The minimum character length of Runes names decreases by one every 17,500 blocks.

As transactions increase, more blocks unlock shorter names.

You can track real-time Runes market share through this heatmap.

Official Issuance Guarantees?

On April 20, 2024, the same time as the Bitcoin halving, the official issued the above ten Runes.

Yes, the ones mentioned earlier (e.g., UNCOMMON•GOODS), created by Casey Rodarmor himself.

At that time, transaction fees soared to nearly NT$1,000, with people frantically minting, similar to Taiwan's ETF 00940 frenzy.

But is this investment truly valuable? I think it's subjective.

Personally, I bought some because I believe in it.

But rationally, this investment may not be worthwhile, more of a historical significance.

Minting these tokens signifies Bitcoin's next era.

The Ordinals Protocol allows artists to issue "real" on-chain NFTs.

The Runes Protocol allows projects to issue tokens (FT), heralding the birth of many economies.

With tokens, DeFi (decentralized finance) will sprout: token swaps, staking, loans, futures, etc.

This is the significance of the first wave of Runes.

But will the official Runes I bought appreciate? It depends on the timeframe, hard to say.

A negative example.

When the Republic of China issued a new 50 TWD coin, the official also issued a commemorative coin set, the first 50 TWD coin!

But later, would you pay 51 TWD for a 50 TWD coin? Haha.

But value is defined by people. One day, a collector might drive the commemorative coin set to NT$1,000, who knows?

The Mona Lisa's smile is worth $100 million, also defined by later generations.

Finally,

If you're still interested, how to buy and hold Runes?

There are two ways to get Runes.

Mint on a decentralized Web3 marketplace

Buy on a centralized exchange

Getting Runes: OKX Web3 Marketplace

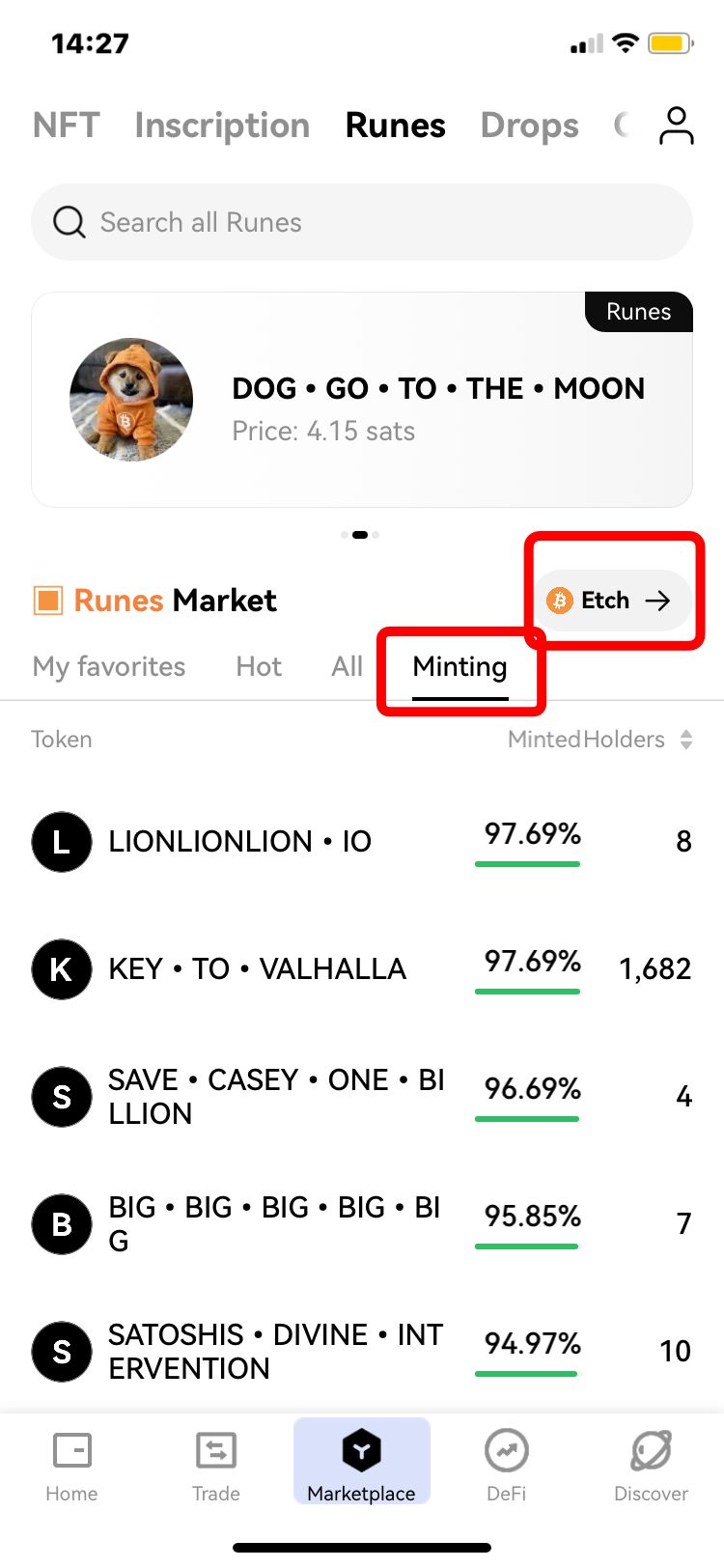

Go to the OKX app, click “Wallet” at the top, then the Marketplace tab at the bottom.

Select the Runes tab at the top.

Click "Etch" at the top right to etch your Runes.

You can also check the Minting tab to see what Runes others are etching, click "Mint" to join the etching.

However, if you want to mint the official ten Runes, they are almost fully minted by now.

Minting yourself is costly, requiring two transaction fees. One for transferring crypto to OKX's Web3 wallet, and another for the minting process.

So, I recommend buying on a centralized exchange.

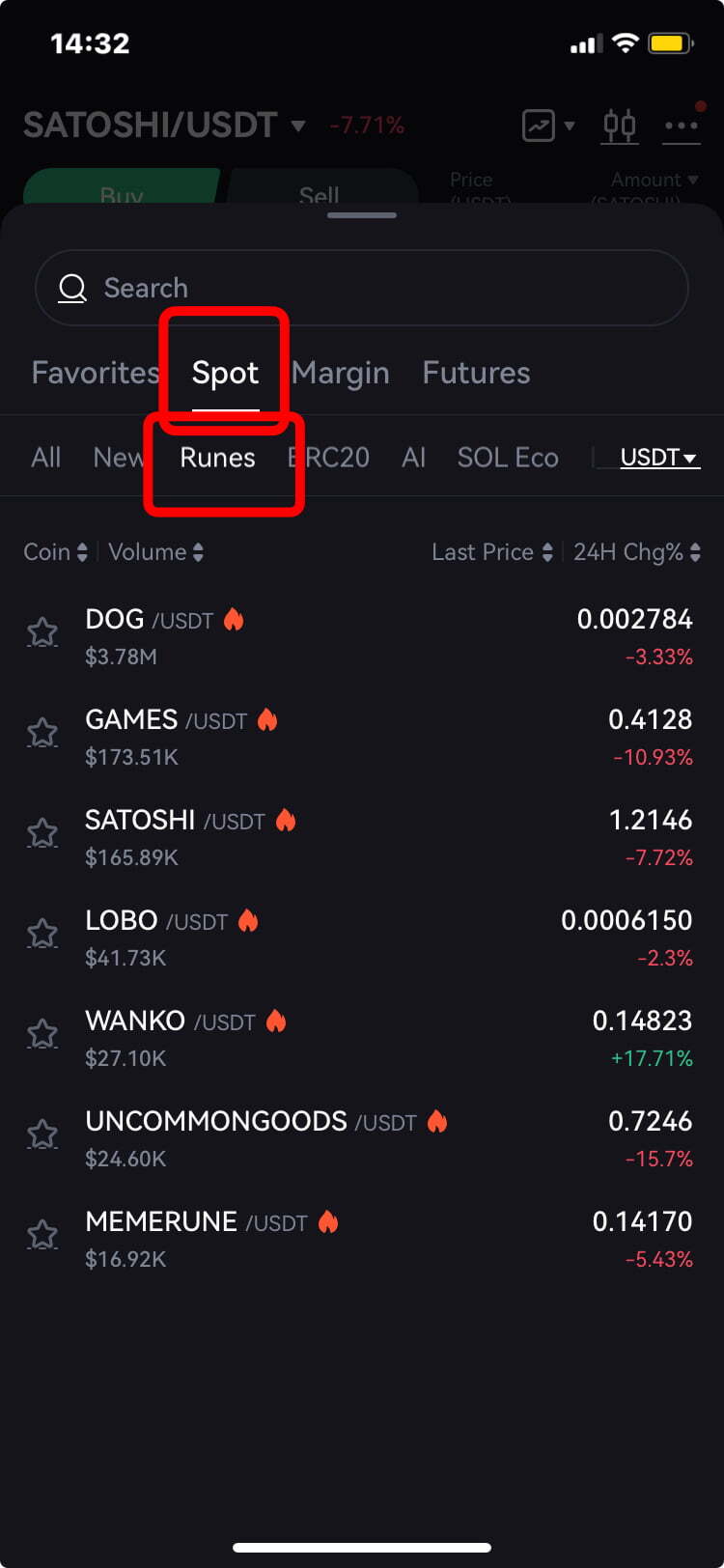

Getting Runes: Gate.io Centralized Exchange

Gate.io is the first exchange to buy Runes with stablecoins.

It's simple.

Click Trade at the bottom,

Then the trading pair at the top left,

Select "Spot" under "Runes" to enter the market.

Investing is like regular spot trading, no need to elaborate.

If you need a detailed step-by-step guide, leave a comment, and I'll supplement it.

---

We introduced the Runes Protocol to solve the BRC20 protocol's data redundancy issue and promote the Bitcoin chain's ecosystem. Casey Rodarmor is the soul of this Bitcoin revolution. Despite the strange naming rules, it's to prevent name squatting. If you're interested in Runes, check out OKX and Gate.io exchanges (both have apps).

This article aligns with the blog's philosophy.

Honestly, most Runes have been declining since their creation on April 20, 2024.

But it also means these Runes are at their lowest point, so I bought more.

As this article aims to convey, do you agree with Casey Rodarmor's values?

Do you believe the Runes Protocol can lead Bitcoin to the next era?

After basic research, investment is a personal value judgment.

If you find this article helpful and want to buy Runes, use my referral codes to register on the exchanges.

OKX referral code: 54028138

OKX referral link: https://okx.com/join/54028138

Gate.io referral code: AVEWULEN

Gate.io referral link: https://www.gate.io/signup/AVEWULEN?ref_type=103

Let's look forward to the future of Bitcoin together.

---

This article is for educational purposes only and does not constitute investment advice. Investors should understand that all investments carry risks.